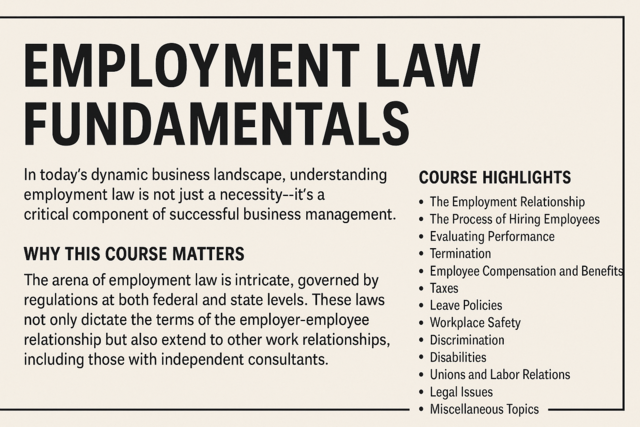

Employment Law Fundamentals

Master Workplace Rights, Empower Your Future

7 Hours average completion time

0.7 CEUs

13 Lessons

27 Exams & Assignments

21 Discussions

13 Videos

14 Reference Files

141 Articles

Mobile Friendly

Last Updated January 2026

In today's dynamic business landscape, understanding employment law is not just a necessity-it's a critical component of successful business management. Whether you're launching a startup or climbing the corporate ladder, a sound grasp of employment law ensures that your actions align with legal guidelines, ultimately protecting your business from potential legal entanglements.

Why This Course Matters:

The arena of employment law is intricate, governed by regulations at both federal and state levels. These laws not only dictate the terms of the employer-employee relationship but also extend to other work relationships, including those with independent consultants. As a result, they encompass various aspects of the workplace-from hiring practices and workplace safety to compensation and labor relations.

This course offers a comprehensive overview of the foundational principles and contemporary issues in employment law. While it doesn't replace the intricate details and nuances that a law degree might offer, it provides vital insights and guidance on the most common employment laws that every employer, supervisor, or HR specialist must know.

Course Highlights:

-

The Employment Relationship: Dive deep into the fundamental dynamics between employers and employees, understanding the rights and responsibilities of both parties.

-

The Process of Hiring Employees: From crafting a precise job advertisement to conducting efficient interviews, ensure that your hiring process is legally sound and effective.

-

Evaluating Performance: Gain insights into best practices for employee evaluation. Understand how to offer feedback and address concerns in a legally compliant manner.

-

Termination: It's often the hardest part of management-letting someone go. Learn the legal and ethical way to handle terminations, minimizing potential legal backlash.

-

Employee Compensation and Benefits: Delve into the intricacies of salary structures, benefits packages, and other compensation-related matters.

-

Taxes: A comprehensive look at employment-related taxes, ensuring you remain compliant while optimizing financial benefits.

-

Leave Policies: Understand the legal guidelines around employee leaves-from maternity and paternity leave to sabbaticals.

-

Workplace Safety: Learn about the regulations governing workplace safety and how to ensure a secure environment for your employees.

-

Discrimination: A deep dive into the policies surrounding workplace discrimination, ensuring your company promotes a culture of inclusivity.

-

Disabilities: Grasp the laws related to employees with disabilities, ensuring your workplace is accessible and compliant.

-

Unions and Labor Relations: An exploration of the role of unions, collective bargaining, and other labor-related matters in today's business world.

-

Legal Issues: From non-disclosure agreements to intellectual property rights, delve into the various legal issues that employers frequently encounter.

-

Miscellaneous Topics: A wrap-up of additional pertinent topics, ensuring you have a well-rounded understanding of employment law.

Who Should Attend?

This course is tailored for a wide audience:

- Small Business Owners: Equip yourself with the knowledge to grow your business while staying legally compliant.

- Corporate Executives: Enhance your leadership skills by understanding the legal nuances of employee management.

- HR Specialists: Ensure your company's HR policies and practices are in line with the latest legal guidelines.

- Managers and Supervisors: Lead with confidence, knowing that your decisions are backed by a sound understanding of employment law.

In conclusion, the world of employment law is vast and ever-evolving. Staying updated ensures not only the growth and success of your business but also its protection from potential pitfalls. Equip yourself with this vital knowledge and lead with confidence in the modern workplace. Join us today and solidify your position as a knowledgeable and legally-aware professional.

- Labor relations understanding

- Ethical employee termination

- Legal guidelines comprehension

- Privacy law considerations

- Anti-discrimination policies

- Disability accommodation knowledge

- Leave policy implementation

- Compensation structure insights

- Workplace safety compliance

- Employment tax knowledge

- Workplace dispute resolution

- Effective hiring and onboarding

- Performance evaluation strategies

-

Motivational and Public Speaking

-

Sensitivity Training for the Workplace

-

Kaizen 101 - An Introduction

-

Report Writing 101

-

General Receptionist

-

Community Development 101

-

Mindfulness in the Workplace

-

Delegation Skills

-

Writing Help Course Bundle

-

Business Math 101

-

Journalism 101

-

Project Management 101

-

Running Effective Meetings

-

Writing Effective Emails in the Workplace

-

Management Consultant 101

-

Developing Great Social Skills

-

Marketing Outreach

-

Ultimate Secretary Training Bundle

-

Business Ethics

-

How to Write Effective Policies and Procedures

-

Modern Marketing Strategies for Small Business

-

Product Management 101

-

Purchasing and Vendor Management 101

-

Creating and Managing a Non-Profit Organization

-

Team Building 101