Introduction

If you have a lot of items to sell, or you have been "hooked" by the eBay seller or buyer bug, you may wish to open a virtual eBay store to showcase niche items, tools, electronic or media equipment, or your collectibles. What you sell on eBay is determined by your own interests, hobbies, and goals. Opening an eBay store may offer you an advantage over individual listings or auction items. Just like a traditional brick-and-mortar store, your store focuses on a specific type of item, promotes and markets that item, and focuses your marketing and promotion efforts on those items.

Overview

You can open any eBay store by choosing from three different subscription packages. Among the greatest advantages of opening an eBay store are low fees for auction style listings and the variety of tools available at each different level.

EBay stores are available in three different packages:

- Basic

- Premium

- Anchor

With each store, fixed price insertion fees differ. For example, as specified by the eBay store overview, here are just a few of the features offered for each different package:

- A basic subscription enables you to list your items for 20 cents each. You are allowed free pictures and receive a free basic report every month for less than $20.

- A premium eBay store allows you to list your items for 5 cents each and offers you free pictures, free use of "Selling Manager Pro," and free advanced reporting for less than $50 a month.

- An anchor store package allows you to list your items for 3 cents each and offers not only free pictures, free use of "Selling Manager Pro," and advanced reporting but also a variety of other customization and marketing tools. This option is a bit more expensive, just under $300 a month, and is recommended for power sellers, or those opening branches to an already established and traditional brick-and-mortar storefront.

In order to determine which type of eBay store will best suit your needs, use the "Fee Illustrator" to determine your selling averages and goals. For example, you may be asked in which category your average monthly sales occur. Such categories include clothing, information or other technology, media, motor parts, or something else. You will be asked how many listings you initiate every month and whether they are auction listings or fixed-price listings.

You also will be asked how many items you sell on a monthly basis under each of these categories, as well as your average selling price for those items. You also will be asked to estimate your shipping costs for both auction and fixed-price sales, how many pictures you typically use for each listing, and whether discounts are available.

Creating a Storefront

Once you have decided what type of store is best for you, creating an online store is simple. Here are the steps:

- Register.

- Choose the type of subscription you want.

- List your items and start selling.

With an eBay store, you can increase your feedback and brand recognition by offering specific merchandise. Offer discounts with the "Markdown Manager" and simplify the management of your eBay store by using free selling tools available with your subscription.

You also can promote and market your store through a variety of e-mail marketing options, promotions, and offers. Tracking your sales is easy with tools made available at even the most basic subscription level. Again, eBay is designed for individuals from all walks of life who wish to sell from home, or as an extension of their already established business. As such, eBay offers sellers step-by-step instructions on how to create, open, and list items in your eBay store, depending on which subscription level you choose.

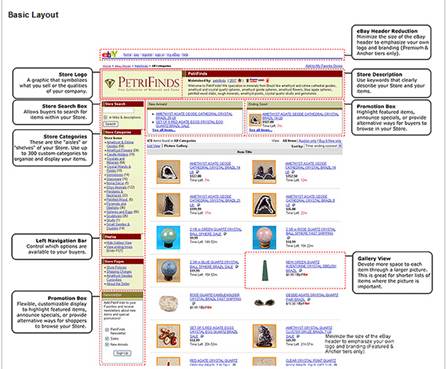

Building your store is relatively easy, and allows you to adapt the appearance, colors, and design of your virtual online storefront. Some of the many options available to you when developing your storefront include:

- choosing a logo;

- inserting a search box;

- listing your store categories;

- providing navigation bars;

- using promotion boxes;

- placing a store description in your header;

- providing gallery views.

While this article has offered you a very brief overview of how you set up a store on eBay, you still have plenty of work ahead of you. Like any other business, understanding and acknowledging the rules and regulations of online businesses is important.

Legal Issues with eBay

Introduction

There is more to creating a profitable business or generating extra income as an eBay seller than simply listing an item and receiving money for it. When you start a business on eBay, you must follow tax laws and regulations. Financial responsibilities and tax obligations also go hand in hand with starting a profitable eBay business. One of the best ways to make this job a little easier is to keep accurate and complete records of all your business expenses and profits.

Registering as an Online Business

If you are serious about making a living by selling on eBay, you need to have a goal or a business plan in place. It does not matter whether you create your business plan on the back of an envelope or hire someone to do it for you. The key is to know the goals you have for your business, the objectives you are trying to meet, and the types of products or merchandise you plan on selling.

In addition, take the time to figure out how you will distinguish yourself from other eBay competitors and develop a strategy for buying products at the lowest prices that you can turn around, mark up for reasonable prices, and increase your sales volume.

When you originally sign up on eBay, you have the option to file as a limited liability company (LLC) or as a corporation. This is not mandatory for those who wish to buy or sell only occasionally.

Look into the differences between these options, as well as the income tax benefits or liabilities involved in each business structure.

Note: If you create an online business with eBay, keep your personal and eBay business expenses and profits separate. This will help at tax time. In addition, check with local business authorities when beginning a home-based eBay business to make sure that operating a business out of your residence will not violate local ordinances.

Remember that your online business should be as serious as any traditional business endeavor. Treat it seriously. Your eBay business should not be a get-rich-quick scheme. It can take several months to a year to firmly establish your foothold in the eBay world and start showing a monthly profit.

Choose your products carefully. Take the time to do your homework and determine the demand for the type of item you wish to sell. It bears repeating because it is important to choose the right product or item that you believe will be salable over a sustained period of time.

Tax Obligations

After you have made some basic decisions regarding your eBay endeavors, take the time to visit the Internal Revenue Service Web site. Look under the business category and then click on the "Starting a Business" tab.

The IRS offers information that business owners are required to know and understand regarding federal taxes and the differences between money earned for a business or a hobby. If you register as an online business, you will be given an Employer Identification Number or EIN to utilize on your income tax forms.

According to the IRS, you have the option of choosing one of several business structures. The legal and tax obligations and considerations for each are described in full detail on the IRS site.

You can register an online business as:

- a limited liability company;

- an S corporation;

- a partnership;

- a sole proprietorship;

- a partnership.

Research the information and regulations for specifying or listing your company as any of these options.

You may also opt to consider yourself self-employed or as an independent contractor or a self-employed business owner if you conduct your eBay business on your own. Keep in mind that as a self-employed individual, you will be responsible for paying estimated quarterly taxes to meet your tax obligation, which of course is based on the income generated by your eBay business.

Familiarize yourself with the types of forms that are required by the IRS for claiming profits or losses on your eBay business. Forms, information, and publications are available on the IRS.gov Web site, as well as information regarding the deduction of expenses, filing and paying your taxes, and compliance and enforcement.

Familiarize yourself with the types of forms that are required by the IRS for claiming profits or losses on your eBay business. Forms, information, and publications are available on the IRS.gov Web site, as well as information regarding the deduction of expenses, filing and paying your taxes, and compliance and enforcement.

Many individuals who start their own home-based businesses use accounting software such as Quicken to help track their expenses. Tax preparation software companies such as Turbo Tax enable you to automatically import data from your Quicken data files into your income tax forms. This will cut down on frustration and help avoid mistakes when filling out your tax forms.

A good rule of thumb is to take roughly 13 percent to 15 percent from each of your sales and place it into a separate account that will help you meet your tax obligations. Doing so will help prevent unpleasant surprises at the end of your tax year. The self-employment tax rate for 2011 is 13.3 percent. Invest in a calculator and do your best to take that amount directly off the top of your profit for eBay sales that reach over a certain amount, as determined by the IRS Web site.

You may also estimate your tax obligation by determining your income over the past three, six, nine, or 12 months if applicable. Determine your tax obligation based on your profits.

The IRS site offers a wealth of information and resources regarding the filing and payment of your business taxes. Articles regarding employment taxes for small businesses, estimated taxes or pay-as-you-go tax, extension of tax filing and reporting are offered. A small business tax calendar offers a variety of information on business taxes, as well as payment options, including electronic filing, forms, and the most common tax filing dates. Issues, tips, advice, and information relevant to small business owners is also available on the IRS Web site.

Conclusion

We wish you the greatest success in your eBay endeavors, whether you buy or sell one item or thousands as a power seller or as a successful eBay store owner. We urge you to explore the eBay Web site, as well as options regarding one of the most lucrative home-based business options out there today. Have fun and make some money while you are doing it.