Balance Sheet: Review

As we have learned, the balance sheet, also known as the "statement of financial position," encompasses a company's holding information inclusive of its assets, liabilities. and equity, or net worth.

In combination with the financial statement and cash flow inventory, the balance sheet is the cornerstone of a company's financial disclosures.

Indicative of a business's financial status at any given point, the balance sheet adheres to the following equation:

Assets = Liabilities + Owners' Equity

Triad of Financial Components

We have previously discussed balance sheets and the above formula, but what we have not touched upon was the three interwoven components: assets, liabilities, and equity.

These three components serve to create the framework for a company's cash flow based upon a double-entry system of debits and credits. While assets are recorded on the top or left-hand side of the balance sheet, liabilities and owners' equity are recorded on the bottom or right-hand side.

Every company will employ its own style for maintaining ledgers, but each will include three categories: assets, liabilities, and owners' equity. As a means of implementing simplified tracking methods, companies typically set up specific sub-accounts, such as current assets or long-term liabilities, within each of the three principal categories.

Assets

In the broadest sense, an asset pertains to anything the company owns that is of value; this description also extends to cash.

Specifically with respect to business and accounting principles, an asset is any economic resources controlled by an entity that are both a result of previous transactions and a soon-to-be beneficiary of future economic activities. Such examples include: cash, equipment, land, and property.

The three intrinsic qualities of an asset are the following :

- It embodies a future benefit, either on its own or in combination with other assets. For instance, in the case of for-profit enterprises, assets contribute either directly or indirectly to future net cash flows. In not-for-profit organizations, assets contribute to provide services.

- The business entity has controlled access to the asset's benefits.

- The deal or occurrence that entitled the business to have control over the asset was something that happened in the past.

Assets on the Balance Sheet

On the balance sheet, assets are recorded based upon their dollar values. The full dollar value gets recorded on one side of the balance sheet as an asset while the amount owed gets recorded on the other side as a liability.

Main types of assets include:

- Current assets : These assets are associated with dollar amounts that continually fluctuate. Examples include cash, accounts receivable, inventory, and raw materials your company uses to make a product. On the balance sheet, they should be ranked in order of their liquidity, essentially meaning the time required to convert them into cash.

- Investments: Companies often employ portfolio managers to oversee the management of securities; e.g., stocks and bonds. Akin to cash or property, investments are considered assets and need to be disclosed along with other valuables.

- Capital assets: Also called plant assets, capital assets are permanent items owned by the company. Examples of capital assets include land, buildings, equipment, and vehicles. Additionally contained within this group are electronic and technology items, furniture, and other material goods, with the stipulation that these items are to be used for business purposes, not personal.

- Intangible assets: Within this grouping are such items as intellectual properties; e.g., copyrights, franchises, goodwill, patents, and trademarks, as well as additional nonmaterial assets, services, and benefits, which are collectively referred to as "intangibles."

Liabilities

Generally speaking, a liability is viewed as anything a company owes, either to people or other businesses. This could entail money owed to a supplier; payroll due to employees; taxes that need to be paid to local, state, and federal tax agencies; and credit amounts carried with banks or other lending institutions.

Note : While this list is not all-inclusive, it should serve to provide a general sense of the types of financial obligations that fall into the liability category on the balance sheet.

The two main types of liabilities include:

- Current liabilities: With respect to the deadline for payment, current liabilities are those invoices that need to be paid within a year's time. Included within this grouping are such items as bills, money owed to vendors/suppliers, employee payroll, and short-term losses. In general, if a liability must be paid within a year, it is considered current.

- Long-term liabilities: This group includes any debt that extends beyond a one-year period; e.g., a mortgage.

Unfunded Liabilities

One of the newer accounting buzzwords is unfunded liabilities. This term applies to those liabilities, or debts, not covered under the original budget. This term first came to the public forefront with the federal government's strategy of depositing markers, or chips for money owed, into trust fund accounts, the amounts of which will eventually need to be repaid.

At root, unfunded liabilities are ways that organizations can duplicitously spend and save the same sum of money. An example of this would be taxpayers' Social Security funds.

While not necessarily the most ethical procedure, it is something that has been used with select funds supposedly tucked away in reserve for future use. These funds are then prematurely tapped for other purposes, thus leaving persons believing the money is still available for its original intent.

Also known as capital, shareholders' equity, or net worth, owners' equity means any debts owed to the business owners. Within publicly traded companies, outstanding preferred and common stock, capital surplus, and retained earnings also represent owners' equity.

Essentially defined as "the residual interests in the assets after deducting liabilities," the formula for calculating equity is as follows:

Owners' Equity = Assets - Liabilities

In its simplest form, owners' equity represents funds that would be available to the collective owners if the company were to sell off all its assets and pay all of its liabilities.

While not too difficult a concept to understand, equity increases when owners invest money into the company and/or when the company shows a profit and keeps those earnings in the company rather than funneling them into a dividend.

The Income Statement: Revenue, Expenses, Income, and Retained Earnings

When dealing with accounting, you need to understand income statements and balance sheets. These reports tell you where the company stands financially for any given period of time. Once you understand how to read a company's financial statements, you can make the right decisions to increase the company's revenue and profit.

The Income Statement

The purpose of the income statement is to provide investors, owners, shareholders, and other interested people periodic reports about how the company is doing financially. The income statement should include revenue, expenses, and net income or profit, as well as the timeline the report represents, which is known as the accounting period. Almost all companies will produce an income statement annually and often run reports for more frequent accounting periods. For example, some organizations may choose to run the income statement biweekly, monthly, or quarterly. Needless to say, an astute owner or manager runs this report frequently.

There are many reasons why the income statement is so important to interested parties. It is almost impossible to succinctly list all its effective benefits. However, its most obvious and important purpose is to show whether the sum total of all assets of an organization have increased or decreased during the accounting period. In short, it answers, in numbers, the question: "How well did we do?"

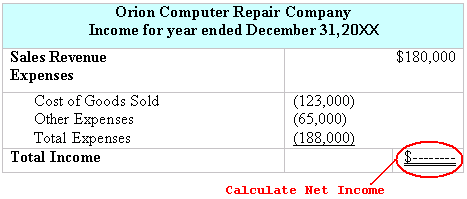

The following is an example of an income statement for a small computer repair shop called Orion Computer Repair Company:

A few things to note about this example:

- The name of the company is at the top of the income statement.

- The second line is the accounting period for the report.

- As typical with income statements, this one shows revenue first, then expenses, as expenses are deducted from revenue. Last is the total income, or bottom line.

- Negative numbers are represented in parentheses, although it is not necessary to use them because you should know that expenses are always negative.

- As with all financial statements, you are reading this from top to bottom.

Revenue

Without revenue, there is no business, at least, not in the long run. Most newcomers to the accounting world understand that revenue means you are receiving income, or cash from sales. However, many newcomers will erroneously confuse revenue with profit. So let us be absolutely clear what revenue is.

Revenue for a company is the total amount of income received from sales, interest, dividends, etc. Revenue is divided into separate categories that indicate where the revenue came from and then summed up for the income statement. Revenue usually is divided into broad categories, then totaled on the income statement so investors can see what parts of the company received how much revenue.

If our little enterprise, Orion Computer Repair Company, repaired 200 computers at the cost of $200 per computer, its revenue would be $40,000. But this does not cover the cost of repairs to the computers and the computer spare parts used to fix the computers. While the company repaired each computer for $200, it cost $120 to fix each computer. The total expenses incurred for repairing those 200 computers added up $24,000. Therefore, the company's profit, the money made after paying off expenses, is only $16,000. As you can see, profit does not equal revenue. Revenue is the total amount of income received for a given period of time. Profit is how much money is retained after all the expenses have been deducted.

Expenses

Expenses are the cost of doing business, the cost of goods sold, and the use of any services. If the Orion Computer Repair Company pays $100 for spare parts for each computer fixed and $20 in labor to fix those computers, then its cost of goods sold (expense) would be $120 a computer. Expenses include payroll, utilities, rent, insurance, vehicles, etc.

Net Income

Different people call net income many different things. Some people refer to it as profit; some people refer to it as just income or earnings. In financial statements, it is common practice to call it "net income." For example, when public corporations post their quarterly earnings, they will seldom use the word profit because, in general, profit has some negative associations. Profit is often seen as corporate greed and the reason why children in China work 18-hour days in American-owned factories. In the financial world, profit is usually referred to as net income. Net income is a good term because the interested party without question understands that it is a sum of calculations.

Net income is defined as the difference between an organization's total revenue and its total expenses for a specific period of time, known as the accounting period. So when you see or hear the term "net income," think "profit."

Retained Earnings

If you remember the fundamental accounting equation, Assets = Liabilities + Owners' Equity, also remember that retained earnings are part of owners' equity. It is a major component of the balance sheet. Retained earnings are the continued profit part of the owners' equity. There are two parts to owner's equity: contributed capital, or seed money, and retained earnings, which can be summarized as profit/net income = revenue - expenses.

As typical when learning the terminology of any subject, you will see several terms used to mean the same thing or similar things. So far, we have seen that income, profit, net income, earnings, and retained earnings all mean essentially revenue minus expenses. The only major difference is that when you use retained earnings, you are usually referring to the balance sheet or the accounting equation (owners' equity), and it is cumulative, meaning the overall retained earnings for a company will increase from year to year for profitable companies. Hence, the word "retained." Simply put, it is profit saved.

Income Tax

Income tax is exactly what it sounds like, and the same thing you calculate every year for yourself. It is the tax on a company's income. The important thing to note is that most accountants treat income tax as an expense, though accountants could alternatively look at it as a complete loss or that the government is an investor entitled to some portion of a company's profits. For our purposes, we will consider it an expense to be deducted from revenue. The problem is deceiving, and financial statements should show or otherwise itemize pre- and post-tax expenses.

Cash and Accrual Accounting

All companies must choose how they are going to account for their revenue and expenses. They choose to use either cash accounting or accrual accounting. In cash accounting, a company does not claim revenue until it actually has received money for services or goods; for example, physically received a check. Additionally, expenses are not realized until the check has left the company to pay for the expense. This works well for small businesses, but the majority of larger companies will use the accrual method of accounting, also known as accrual basis.

In accrual accounting, revenue and expenses are claimed at the time they occur. For example, revenue is recorded when services of a business have been provided (service revenue), or the goods of a company have been shipped (sales revenue). This means that if the Orion Computer Repair Company sends out 20 fixed computers and invoices to the customers for each computer, the company would account for the money as revenue even though it has not yet received payment under the accrual method of accounting.

The idea behind accrual accounting is to maintain a current and accurate picture of what is going on financially in a company at a specific point in time. If the Orion Computer Repair Company has a fantastic summer of repairing computers but did not get paid for services until three months later, under the cash basis accounting system it would look as if summer is slow for repair sales and that fall and/or winter are extremely profitable. In accrual accounting, the company would see a more accurate representation of when computer repair sales are highest.

Problem 1:

Which of the following is considered revenue and which of the following is considered an expense?

|

1. |

The Orion Computer Repair Company (OCRC) sells spare computer parts. |

Revenue or Expense? |

|

2. |

OCRC buys spare parts to fix computer. |

Revenue or Expense? |

|

3. |

OCRC repairs 20 computers and bills each customer $200 per computer. |

Revenue or Expense? |

|

4. |

OCRC pays rent for the next 12 months. |

Revenue or Expense? |

|

5. |

OCRC earns interest in its corporate bank account. |

Revenue or Expense? |

Answer: 1. OCRC sells spare computer parts: This is revenue. Anything that brings in cash/money into the company is revenue. 2. OCRC buys spare parts: That costs money and so is an expense. 3. OCRC repairs and bills customers $200/computer: That is revenue; the company has a cash inflow of $200/computer. 4. Paying rent is always an expense. 5. Earning interest is a cash inflow and thus a revenue stream.

Problem 2:

Which of the following are liabilities and which of the following are assets?

|

1. |

The Orion Computer Repair Company (OCRC) owns several diagnostic computers. |

Asset or Liability? |

|

2. |

OCRC buys spare parts on credit. |

Asset or Liability? |

|

3. |

OCRC owns a flatbed truck to deliver computers. |

Asset or Liability? |

|

4. |

OCRC owns a complicated computer system to handle all its accounting financials. |

Asset or Liability? |

|

5. |

OCRC took out a loan from a bank to pay for rent. |

Asset or Liability? |

Answer: 1. OCRC owns diagnostic computers: This is an asset; it can be sold. 2. OCRC buys spare parts on credit: That is a liability. Buying on credit is the same as a loan. 3. OCRC owns a flatbed truck: The company owns an item of value; it is an asset. 4. Again, the company owns another system; this is an asset. 5. All loans a company takes are liabilities.

Problem 3:

The following is a statement of liabilities and assets for the Orion Computer Repair Company:

Cash Account: 25,000

Computer Spare Parts: 7,500

Bank Loan: 8,500

Computer Diagnostic Equipment: 8,500

Question: What is the sum total of assets given the above statement?

Answer: The total assets of OCRC equal the sum of all assets. Assets in this statement are 25,000 in cash account, 7,500 in spare parts, and 8,500 in diagnostic equipment. The bank loan is a liability, not an asset. Thus, the assets in this financial statement total 41,000.

Problem 4:

Given the income statement shown below, what is the net income for this accounting period?

This should be straightforward. We know that net income is total revenue minus total expenses. In this income statement, we see sales revenue at 180,000 and total expenses at 188,000; thus, net income is negative (8,000) dollars. The term for when expenses exceed revenue is known as a loss, such as in this situation.