The Balance Sheet:

A company will use a Balance Sheet to summarize its financial position at a given point in time. It summarizes a company's assets, liabilities, and owners' equity. The balance sheet is derived using the accounting equation. The balance sheet is also commonly referred to as the statement of financial position.

Debits and Credits:

Every accounting transaction must be either a credit or debit. Quite simply, either you are crediting money or debiting money to the overall balance. In bookkeeping texts, you will see debits abbreviated as "Dr." and credits abbreviated as "Cr."

"T " Accounting:

When representing the debits and credits equation, accountants and bookkeepers commonly use the "T" accounting method. In this representation, you draw a big capital letter "T" on a paper, and on one side of the T you place your debits; on the other side of the T, you place your credits; and on the top of the T, you usually name the item you are debiting or crediting, as shown:

|

Accounts Payable |

||

|

|

| |

|

Double-entry Accounting:

There are two methods accountants use to show credits and debits for financial transactions. They can use the single-entry, or one-column method, or the more widely used double-entry, or two-column, method to show debits and credits. When using double-entry accounting, debits must always equal credits:

|

This is yet another extremely important accounting equation to remember. Because debits must always equal credits, it is common practice to use double- entry accounting to prevent errors. In double-entry accounting, every financial transaction must have two journal entries, or affect two different accounts: the debit transaction and the credit transaction. The theory behind this is that for every transaction, you are taking money away from one account and adding it to another account. For example, if your company purchases $800 in business supplies, you would be inclined to think of taking $800 cash out of the checking account, and you would be right. However, in double-entry accounting, you also need to add this amount to inventory, as shown:

$800.00 subtracted (credited) in Cash

$800.00 added (debited) in Inventory

This accounts for where the cash went. The cash did not just disappear into thin air; it turned into business supplies, thus this change is reflected correctly in double-entry accounting. It is equally important to note that with the equation Debits = Credits, the left side must always contain debits, and the right side must contain only credits. Order and consistency when representing debits and credits are paramount.

We need to clarify one more very confusing point when dealing with double-entry accounting, and debits and credits specifically. You need to disregard your traditional understanding of how credits work in your everyday life. In your normal checking account, credits usually refer to money increasing in your account, and debits usually refer to decreasing the money in your account. If you add money to your checking account, your checking account is credited and your bank account increases. This point of view differs from that in the accounting world because you are viewing your checking account through your own personal perspective, not the bank's perspective. In the accounting world, financial transactions are looked at as if from the bank's point of view.

Therefore, if a financial transaction causes a company's checking account to be credited, its balance decreases. Additionally, crediting an account such as accounts payable will ultimately increase the balance of a company. This leads to much confusion when referring to credits and debits. When discussing credits and debits, we need to be absolutely certain we understand what we are doing to what side of the accounting equation.

We can clarify our understanding of what is going on with credits and debits by returning to the Debits = Credits equation. Debits must always be on the left side or left column, and credits must always be on the right side or right column. Whether a debit or credit can either increase or decrease an overall account balance is determined by the account type that is receiving the credit or debit transaction. For example, if you are adding numbers to the debit side of your retained earnings account, you are decreasing the account value. But if you are adding numbers to the debit side of your cash account, you are increasing the account value. The following chart better summarizes with plus and negative signs what happens to your overall account balance when you add numbers to the respective credit/debit accounts:

The summary below illustrates how debits and credits are being recorded in the fundamental accounting equation A = L + OE:

|

Problem 1:

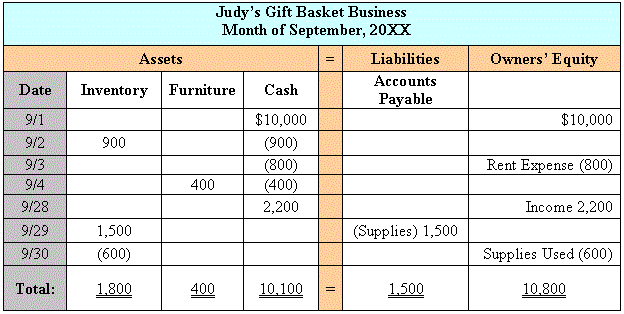

Judy decided to start her own gift basket business. Here is a summary of transactions she made for the month of September:

|

Question: Using the above transactions, how would you set up a simple diagram of a balanced accounting equation for each transaction for Judy's gift basket business?

Answer: A simple balanced equation for the gift basket business may look like this:

As you can see, if you add up all the assets and compare it to the sum of liabilities and owners' equity, they are equal (12,300 = 12,300).

Problem 2:

Solve for each of the missing variables in these equations:

|

Assets |

= |

Liabilities |

+ |

Owners' Equity |

||

|

1. |

$28,000 |

??? |

$20,000 |

|||

|

2. |

??? |

9,200 |

80,000 |

|||

|

3. |

86,000 |

??? |

86,000 |

|||

|

4. |

45,000 |

22,000 |

??? |

|||

|

5. |

39,000 |

9,000 |

??? |

|||

|

6. |

??? |

6,500 |

27,000 |

|||

Answer: The answer for each of these problems can be found by using simple algebra and solve for x or in this case ???. We know that Assets = Liabilities + Owners Equity, so for each of these we just solve for x:

|

Assets |

= |

Liabilities |

+ |

Owners' Equity |

||

|

1. |

$28,000 |

8,000 |

$20,000 |

|||

|

2. |

89,200 |

9,200 |

80,000 |

|||

|

3. |

86,000 |

0 |

86,000 |

|||

|

4. |

45,000 |

22,000 |

23,000 |

|||

|

5. |

39,000 |

9,000 |

30,000 |

|||

|

6. |

33,500 |

6,500 |

27,000 |

|||

Problem 3:

Determine the effect on owners' equity (increased, decreased, stayed the same) for each of the following transactions that occurred in the month of September for the Orion Computer Repair Company:

|

Answer:

- The first item is a direct increase in owners' equity (capital).

- The second item is an expense (cash expense), so that is a decrease in owners' equity.

- The third item is a cash increase from computer sales (revenue); this is an increase in owners' equity.

Problem 4:

For each of the following statements, show by account where the debits and credits would go:

|

|

Answer: This is tricky because you may be inclined to think that we would credit a cash account (under assets). However, as we have studied earlier, asset increases are shown as a debit. This is a very important rule to remember. The balanced, double-entry method of showing credits and debits would be as follows:

|

|

Answer: Paying $1,800 in cash for computer parts is a cash expense that directly affects inventory. Essentially, we are just dealing with the left side of the equation (assets) and we are changing the form of an asset from cash to inventory (spare parts), as shown:

|

|

Answer: The important part to remember about this statement is that it affects both sides of the accounting equation. You are debiting cash (because you are increasing cash) and you are crediting revenue (owners' equity) on the other side of the equation because you are increasing capital. You should understand more clearly now how credits and debits work on each side of the equation.

|

|

Answer: Since OCRC is purchasing computer spare parts on credit (a liability), you are increasing both liabilities and inventory (assets) on both sides of the accounting equation:

|

|

Answer: This is fairly easy to solve. We need to debit the Accounts Payable account the money that we were credited ($2,500), and we need to then credit the amount in cash to pay off the bill. Both sides of the equation are affected, as shown:

|