Online Class: Investing 201 — Intro to Commodity, Options, and Futures Markets

no certificate

with CEU Certificate*

-

13Lessons

-

17Exams &

Assignments -

2,444Students

have taken this course -

8Hours

average time -

0.8CEUs

Course Description

Mastering the Art of Futures Trading: Your Comprehensive Guide

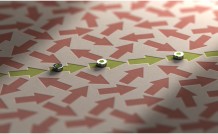

Have you ever been intrigued by the ebb and flow of corn prices on the commodities market? Perhaps you possess a penchant for taking calculated risks, a zest for exhilarating financial ventures, or an allure to the strategic game that is trading. The realm of futures trading, often dynamic and tinged with emotion, promises lucrative returns, making it a magnet for those with a keen financial acumen. Indeed, it offers an opportunity to not only trade with personal accounts but also manage portfolios for a diverse clientele. Experiencing successful trades in this domain is undeniably thrilling. However, a caveat: futures trading is not everyone's cup of tea. The stakes are high, and uninformed trading decisions can lead to significant monetary setbacks.

As of 2023, the futures market has witnessed an upward trajectory in terms of volume and global participants. Recognizing the burgeoning interest and the critical need for education in this space, we present "Investing 201: Commodity Markets and Futures Trading". This course stands as a lighthouse for those navigating the turbulent waters of futures trading.

Course Overview:

Investing 201: Commodity Markets and Futures Trading delves deep into the intricacies of the commodity and futures landscape. Beginning with the roots of commodity markets, it traverses through the mechanics of futures trading, demystifying complex jargon and decoding the nuances of charts.

What's in Store?

-

History of Commodities Markets: Journey through time and explore the genesis, evolution, and milestones of commodity trading.

-

Futures Markets: Unravel the dynamics of futures markets, their significance, and the forces that shape them.

-

The Contract: A deep dive into the essence of trading – the contract. Understand its formulation, components, and significance.

-

Contract Types: Decipher the various contract types available in the market and their unique attributes.

-

Making a Trade: Transition from theory to practice. Learn the steps, strategies, and subtleties of executing a trade.

-

Trading on Margin: Understand the concept of margin trading, its advantages, risks, and real-world applications.

-

Regulatory Environment: Navigate the rules of the game. Familiarize yourself with the regulatory bodies, frameworks, and compliance mandates.

-

How the Markets Work: Decode market mechanisms, influencers, and the interplay of various factors that drive prices and trends.

-

Options: Explore the versatile world of options trading, its strategies, and applications.

-

Trading Strategies: Equip yourself with proven trading methodologies, tactical approaches, and decision-making frameworks.

-

Charts: Charts are the heartbeats of trading. Learn to interpret, analyze, and derive actionable insights from them.

-

Trading Systems: Delve into automated trading systems, their design, advantages, and practical utility.

-

Careers in Futures Trading: Discover potential career paths, roles, and opportunities in the futures trading ecosystem.

Who Should Enroll?

If you're someone who doesn't waver easily under market pressure, can gracefully navigate through losses, and possesses the financial bandwidth to learn while on the job, then futures trading might just be your calling. But, before you plunge, understanding the basics is pivotal. This course is tailor-made to provide you with a robust foundation.

The Futures Trading Advantage:

The futures market, with its vast potential, has been a realm where many have found not just monetary success, but also a fulfilling career. According to a 2023 report, the global futures market has grown exponentially, attracting a myriad of investors and traders. Such growth underscores the need for well-informed, strategic, and educated participants.

Conclusion:

In a world where financial decisions can make or break fortunes, being well-prepared is not just an advantage; it's a necessity. "Investing 201: Commodity Markets and Futures Trading" is not just a course; it's your mentor, guide, and the first step towards a potential career in futures trading. Equip yourself with knowledge, refine your strategies, and step confidently into the world of futures trading.

- Completely Online

- Self-Paced

- Printable Lessons

- Full HD Video

- 6 Months to Complete

- 24/7 Availability

- Start Anytime

- PC & Mac Compatible

- Android & iOS Friendly

- Accredited CEUs

Course Lessons

Lesson 1 - History of Commodities Markets

Lesson 1 Video

Lesson 1 Video Lesson discussions: Reasons for Taking this Course

Lesson discussions: Reasons for Taking this Course Complete Assignment: An Introduction

Complete Assignment: An Introduction Complete: Lesson 1 Assignment

Complete: Lesson 1 Assignment Assessment: Quiz for Lesson 1 - History of Commodities Markets

Assessment: Quiz for Lesson 1 - History of Commodities Markets

Lesson 2 - Futures Markets

Lesson 2 Video

Lesson 2 Video Lesson discussions: Future Class Trading Options

Lesson discussions: Future Class Trading Options Complete: Lesson 2 Assignment

Complete: Lesson 2 Assignment Assessment: Quiz for Lesson 2 - Futures Markets

Assessment: Quiz for Lesson 2 - Futures Markets

Lesson 3 - The Contract

Lesson 3 Video

Lesson 3 Video Assessment: Quiz for Lesson 3 - The Contract

Assessment: Quiz for Lesson 3 - The Contract

Lesson 4 - Contract Types

Lesson 4 Video

Lesson 4 Video Assessment: Quiz for Lesson 4 - Contract Types

Assessment: Quiz for Lesson 4 - Contract Types

Lesson 5 - Making a Trade

Lesson 5 Video

Lesson 5 Video Lesson discussions: Analyse This!

Lesson discussions: Analyse This! Assessment: Quiz for Lesson 5 - Making a Trade

Assessment: Quiz for Lesson 5 - Making a Trade

Lesson 6 - Trading on Margin

Lesson 6 Video

Lesson 6 Video Assessment: Quiz for Lesson 6 -Trading on Margin

Assessment: Quiz for Lesson 6 -Trading on Margin

Lesson 7 - Regulatory Environment

Lesson 7 Video

Lesson 7 Video Assessment: Quiz for Lesson 7 - Regulatory Environment

Assessment: Quiz for Lesson 7 - Regulatory Environment

Lesson 8 - How the Markets Work

Lesson 8 Video

Lesson 8 Video Lesson discussions: Finding a Balance

Lesson discussions: Finding a Balance Assessment: Quiz for Lesson 8 - How the Markets Work

Assessment: Quiz for Lesson 8 - How the Markets Work

Lesson 9 - Options

Lesson 9 Video

Lesson 9 Video Assessment: Quiz for Lesson 9 - Options

Assessment: Quiz for Lesson 9 - Options

Lesson 10 - Trading Strategies

Lesson 10 Video

Lesson 10 Video Assessment: Quiz for Lesson 10 - Trading Strategies

Assessment: Quiz for Lesson 10 - Trading Strategies

Lesson 11 - Charts

Lesson 11 Video

Lesson 11 Video Assessment: Quiz for Lesson 11 - Charts

Assessment: Quiz for Lesson 11 - Charts

Lesson 12 - Trading Systems

Lesson 12 Video

Lesson 12 Video Assessment: Quiz for Lesson 12 - Trading Systems

Assessment: Quiz for Lesson 12 - Trading Systems

Lesson 13 - Careers in Futures Trading

Lesson 13 Video

Lesson 13 Video Lesson discussions: End of Course Poll; Program Evaluation Follow-up Survey (End of Course); Course Comments

Lesson discussions: End of Course Poll; Program Evaluation Follow-up Survey (End of Course); Course Comments Assessment: Quiz for Lesson 13 - Careers in Futures Trading

Assessment: Quiz for Lesson 13 - Careers in Futures Trading Assessment: The Final Exam

Assessment: The Final Exam

Learning Outcomes

- Summarize history of commodities markets.

- Describe futures markets.

- Describe the options market: creating the contract.

- Define contract types.

- Summarize making a trade.

- Describe trading on margin.

- Summarize regulatory environment.

- Describe how the markets work.

- Describe the options market.

- Summarize trading strategies.

- Summarize trading systems.

- Demonstrate mastery of lesson content at levels of 70% or higher.

Additional Course Information

- Document Your Lifelong Learning Achievements

- Earn an Official Certificate Documenting Course Hours and CEUs

- Verify Your Certificate with a Unique Serial Number Online

- View and Share Your Certificate Online or Download/Print as PDF

- Display Your Certificate on Your Resume and Promote Your Achievements Using Social Media

Choose Your Subscription Plan

No Certificate / No CEUs

This course only

| Includes certificate | X |

| Includes CEUs | X |

| Self-paced |

|

| Instructor support |

|

| Time to complete | 6 months |

| No. of courses | 1 course |

Certificate & CEUs

This course only

| Includes certificate |

|

| Includes CEUs |

|

| Self-paced |

|

| Instructor support |

|

| Time to complete | 6 months |

| No. of courses | 1 course |

Certificates & CEUs

Includes all 600+ courses

| Includes certificate |

|

| Includes CEUs |

|

| Self-paced |

|

| Instructor support |

|

| Time to complete | 12 Months |

| No. of courses | 600+ |

Certificates & CEUs

Includes all 600+ courses

| Includes certificate |

|

| Includes CEUs |

|

| Self-paced |

|

| Instructor support |

|

| Time to complete | 24 Months |

| No. of courses | 600+ |

Student Testimonials

- "This course was extremely helpful and I am excited to apply what I have learned." -- Shaquinthia H.

Related Courses

-

32 hours

3.2 CEUs

Economics: Complete Edition

+ More Info

32 hours

3.2 CEUs

Economics: Complete Edition

+ More Info

-

7 hours

0.7 CEUs

Financial Analysis 101: Planning and Control

+ More Info

7 hours

0.7 CEUs

Financial Analysis 101: Planning and Control

+ More Info

-

32 hours

3.2 CEUs

Accounting & Bookkeeping 101 for Everyone

+ More Info

32 hours

3.2 CEUs

Accounting & Bookkeeping 101 for Everyone

+ More Info

-

4 hours

0.4 CEUs

Business Budgeting 101: How to Plan, Save, and Manage

+ More Info

4 hours

0.4 CEUs

Business Budgeting 101: How to Plan, Save, and Manage

+ More Info

-

7 hours

0.7 CEUs

Business Analysis

+ More Info

7 hours

0.7 CEUs

Business Analysis

+ More Info

-

3 hours

0.3 CEUs

Business Credit 101

+ More Info

3 hours

0.3 CEUs

Business Credit 101

+ More Info

-

12 hours

1.2 CEUs

Business Math 101

+ More Info

12 hours

1.2 CEUs

Business Math 101

+ More Info

-

7 hours

0.7 CEUs

Introduction to Logic

+ More Info

7 hours

0.7 CEUs

Introduction to Logic

+ More Info

-

5 hours

0.5 CEUs

Habits of Millionaires

+ More Info

5 hours

0.5 CEUs

Habits of Millionaires

+ More Info

-

7 hours

0.7 CEUs

Estate Planning

+ More Info

7 hours

0.7 CEUs

Estate Planning

+ More Info

-

6 hours

0.6 CEUs

Sustainable Development for Business

+ More Info

6 hours

0.6 CEUs

Sustainable Development for Business

+ More Info

-

6 hours

0.6 CEUs

Debt Reduction

+ More Info

6 hours

0.6 CEUs

Debt Reduction

+ More Info

-

5 hours

0.5 CEUs

Personal Finance 101: How to Manage Your Money

+ More Info

5 hours

0.5 CEUs

Personal Finance 101: How to Manage Your Money

+ More Info

-

7 hours

0.7 CEUs

Organizational Behavior in Business

+ More Info

7 hours

0.7 CEUs

Organizational Behavior in Business

+ More Info

-

7 hours

0.7 CEUs

Understanding Financial Statements

+ More Info

7 hours

0.7 CEUs

Understanding Financial Statements

+ More Info