Online Class: Personal Finance 101 — How to Manage Your Money

no certificate

with CEU Certificate*

-

11Lessons

-

16Exams &

Assignments -

8,115Students

have taken this course -

5Hours

average time -

0.5CEUs

Course Description

Imagine you're going on a trip…It sounds odd, but your journey to understanding, growing and maintaining personal finance starts with your imagination. That's not all it takes, but, by imagining, dreaming and believing, these intangibles will begin to take shape.

Of course, you'll need tangible actions to achieve your results. After all, you can believe you want to go on a cruise, but until you step on the boat, you'll never get there.

During this course, you'll learn the ins and outs of your individual financial journey in a fun and unique way--as a travel itinerary. You'll be provided with everything you need to understand your spending habits, chart your progress, grow your current savings and achieve your dreams. This course is broken up into three parts: Plan, Execute and Travel. Plan--maintain checking and savings accounts, create assessments in order to understand your financial standing and create a foundation for your financial standing, Execute-- manage debt, build and manage your credit score as well as balance accounts for future financial security--and finally, Travel--live your dream by generating wealth and controlling spending, making sound investments in stocks and bonds, and even begin starting and growing retirement accounts. These are your steps to financial freedom and you can achieve them all from within the comfort of your home. No matter where you are in your journey, by end of this course, you'll have a clear map to where you want to go and helpful hints to guide you along the way.

Course Motivation

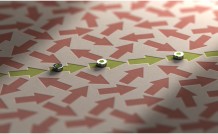

Say you're on a cross-country drive. The goal is to get from New York to Los Angeles. You pack up your trusty car, hop in, and head west to begin your trip. What's wrong with this picture?

Ah, the map, perhaps a weather report, and what about accommodations once you arrive? These elements will not only make your journey more enjoyable, they will also create a safer, more clearly-defined route. The choice is yours: You could wind your way through unknown streets and freeways, guessing which route is best and reacting to whatever life throws at you, or with a little planning, you could relax and enjoy the ride.

Whether you are just starting your career with a brand new job or you have been managing your own finances for many years, one fact remains consistent.

Personal financial management is the map, meteorologist, and travel agent in plotting your journey to maintaining and sustaining your own wealth.

The idea of managing finances can sometimes be daunting depending on your age, amount of accrued debt, and thoughts and feelings surrounding money. But, it is never too late to begin!

The trip begins…

Even better than a cross-country drive: Imagine a sun-soaked beach in Oahu, Hawaii. In your mind's eye, you lounge on the powdery-white sand, sip a fruity drink and listen to the rolling surf. Then reality sets in. You're not there; in fact, you're not even close to Hawaii. A glance out the window at the snow-covered landscape shows you just how far away you are from the balmy breeze.

Believe it or not, you are a mere three steps away from enjoying your dream vacation -- in the form of financial freedom. The three steps are: 1) Plan 2) Execute 3) Travel.

The first step -- Plan -- includes gathering data. Luckily, since the data is yours, you don't have to go very far. This includes tracking your spending, maintaining your checking and savings accounts, and assessing your true financial worth -- or your assets. The invaluable knowledge can help you in understanding your cash flow, creating a budget to curb overspending, and even in getting loans and investing.

With a little more effort, you can take the second step -- Execute. Action is the key to managing debt. Incurring debt doesn't have to mean giving up everything in order to pay bills. If you are buried under a heap of bills and worried about how to pay these meddlesome debt piles, you need not fret. There are some important and, yes, ingenious money management techniques to ensuring you'll be out of debt -- or at least lessen the load -- and be happier before you know it.

By using the data gathered during your Planning stage, you can balance accounts, create a budget, and either curb your spending, or increase your income.

And finally, you get to relax with step three -- Travel. You know how much you are worth, your bills are manageable and, low and behold, you are able to see the extra money -- or perhaps the possibility of extra money. You can sit atop your data -- or on the beach, and plan ahead. This newfound knowledge can allow you to see the possibility of having your money work for you. Or, if you are big on investing in yourself -- whether with school or a small business -- you can take out loans and create a future with increased earning potential. Or, you can invest your money in stocks and bonds and even retirement accounts.

Okay, perhaps you're not going to travel. Maybe you don't even like to leave your hometown. The bottom line is this: By taking the burden of "have to," off of your financial view, you stand a better chance of actually accomplishing your goals. Managing assets creates new opportunities to make your money work for you. There are infinite possibilities when it comes to investing, managing, and shifting funds. The most important element in doing so is to create consistent efforts over time.

- Completely Online

- Self-Paced

- Printable Lessons

- Full HD Video

- 6 Months to Complete

- 24/7 Availability

- Start Anytime

- PC & Mac Compatible

- Android & iOS Friendly

- Accredited CEUs

Course Lessons

Lesson 1: Introduction to Personal Finances

Lesson 1 Video

Lesson 1 Video Lesson discussions: Reasons for Taking this Course

Lesson discussions: Reasons for Taking this Course Complete Assignment: An Introduction

Complete Assignment: An Introduction Assessment: Lesson 1: Introduction

Assessment: Lesson 1: Introduction

Lesson 2: Assets

Lesson 2 Video

Lesson 2 Video Assessment: Lesson 2: Assets

Assessment: Lesson 2: Assets

Lesson 3: Liquid and Non-Liquid Assets

Lesson 3 Video

Lesson 3 Video Assessment: Lesson 3: Liquid and Non-Liquid Assets

Assessment: Lesson 3: Liquid and Non-Liquid Assets

Lesson 4: Checking

Lesson 4 Video

Lesson 4 Video Lesson discussions: Checking Account

Lesson discussions: Checking Account Complete: Lesson 4 Assignment

Complete: Lesson 4 Assignment Assessment: Lesson 4: Checking

Assessment: Lesson 4: Checking

Lesson 5: Savings Savvy

Lesson 5 Video

Lesson 5 Video Complete: Lesson 5 Assignment

Complete: Lesson 5 Assignment Assessment: Lesson 5: Savings Savvy

Assessment: Lesson 5: Savings Savvy

Lesson 6: Ideas to Generate More Money

Lesson 6 Video

Lesson 6 Video Assessment: Exam 6

Assessment: Exam 6

Lesson 7: Debt

Lesson 7 Video

Lesson 7 Video Complete: Lesson 7 Assignment

Complete: Lesson 7 Assignment Assessment: Lesson 7: Debt

Assessment: Lesson 7: Debt

Lesson 8: Credit Cards

Lesson 8 Video

Lesson 8 Video Lesson discussions: Credit Cards

Lesson discussions: Credit Cards Assessment: Lesson 8: Credit Cards

Assessment: Lesson 8: Credit Cards

Lesson 9: Investments

Lesson 9 Video

Lesson 9 Video Assessment: Lesson 9: Investments

Assessment: Lesson 9: Investments

Lesson 10: Loans

Lesson 10 Video

Lesson 10 Video Assessment: Lesson 10: Loans

Assessment: Lesson 10: Loans

Lesson 11: Conclusion

Lesson 11 Video

Lesson 11 Video Lesson discussions: What do you think about this course?; Program Evaluation Follow-up Survey (End of Course); Course Comments

Lesson discussions: What do you think about this course?; Program Evaluation Follow-up Survey (End of Course); Course Comments Assessment: Lesson 11: Conclusion

Assessment: Lesson 11: Conclusion Assessment: Final Exam

Assessment: Final Exam

Learning Outcomes

- Define what personal finances are and their importance on your life.

- Define your assets.

- Describe and define your liquid and non-liquid assets.

- Describe checking accounts, saving accounts, mobile banking.

- Define what your debt is.

- Summarize what credit cards are and how they can be both helpful and harmful.

- Identify investments.

- Summarize loans and what to look for.

- Demonstrate mastery of lesson content at levels of 70% or higher.

Additional Course Information

- Document Your Lifelong Learning Achievements

- Earn an Official Certificate Documenting Course Hours and CEUs

- Verify Your Certificate with a Unique Serial Number Online

- View and Share Your Certificate Online or Download/Print as PDF

- Display Your Certificate on Your Resume and Promote Your Achievements Using Social Media

Choose Your Subscription Plan

No Certificate / No CEUs

This course only

| Includes certificate | X |

| Includes CEUs | X |

| Self-paced |

|

| Instructor support |

|

| Time to complete | 6 months |

| No. of courses | 1 course |

Certificate & CEUs

This course only

| Includes certificate |

|

| Includes CEUs |

|

| Self-paced |

|

| Instructor support |

|

| Time to complete | 6 months |

| No. of courses | 1 course |

Certificates & CEUs

Includes all 600+ courses

| Includes certificate |

|

| Includes CEUs |

|

| Self-paced |

|

| Instructor support |

|

| Time to complete | 12 Months |

| No. of courses | 600+ |

Certificates & CEUs

Includes all 600+ courses

| Includes certificate |

|

| Includes CEUs |

|

| Self-paced |

|

| Instructor support |

|

| Time to complete | 24 Months |

| No. of courses | 600+ |

Student Testimonials

- "Overall, this course was helpful, which inspired me to continue my financial journey, live within my means and stay financially disciplined. All the materials were great, really enjoyed the videos of all the lessons, fun and educating. Thank you!" -- Patricia W.

- "This course was very helpful in getting me to understand how to manage personal finances. The information, resources, and videos provided were all great tools. I cannot think of anything else that should be added or included in this educational course." -- Abel G.

- "This course was extremely helpful for my husband and I! We learned so much about financial matters and have started to execute the plan! Thank you so much for this knowledge and also for the positive feedback from my assignments!" -- Layla C.

- "I am grateful to the instructor for creating this course and for making the material easy to follow and digest. I don't know what other classes/courses if any, this instructor might have available, but I might be willing to take them as well." -- Julie H.

- "Excellent course and would like to recommend this course to others to follow." -- Ravindrarajah A.

- "Outstanding instructor." -- Todd A.

- "I was very pleased with this course." -- Sarah M.

- "The instructor was beyond excellent." -- Janet D.

- "The instructor was very good and gave positive feedback. Found everything in the class most useful." -- Marlis W.

- "The Instructor seemed very nice, and answered me in a timely manner. I really enjoyed the lessons on debt, and the one on Loans. These were my favorites because of the fact I wanted to know more about this in my life. I am not overwhelmed with debt but don't want to be!" -- Theresa J.

Related Courses

-

6 hours

0.6 CEUs

Sustainable Development for Business

+ More Info

6 hours

0.6 CEUs

Sustainable Development for Business

+ More Info

-

14 hours

1.4 CEUs

QuickBooks Online

+ More Info

14 hours

1.4 CEUs

QuickBooks Online

+ More Info

-

12 hours

1.2 CEUs

Business Math 101

+ More Info

12 hours

1.2 CEUs

Business Math 101

+ More Info

-

4 hours

0.4 CEUs

Purchasing and Vendor Management 101

+ More Info

4 hours

0.4 CEUs

Purchasing and Vendor Management 101

+ More Info

-

8 hours

0.8 CEUs

Quicken Tutorial: All Versions

+ More Info

8 hours

0.8 CEUs

Quicken Tutorial: All Versions

+ More Info

-

17 hours

1.7 CEUs

Basic Math 101

+ More Info

17 hours

1.7 CEUs

Basic Math 101

+ More Info

-

5 hours

0.5 CEUs

Habits of Millionaires

+ More Info

5 hours

0.5 CEUs

Habits of Millionaires

+ More Info

-

8 hours

0.8 CEUs

Payroll Management 101

+ More Info

8 hours

0.8 CEUs

Payroll Management 101

+ More Info

-

14 hours

1.4 CEUs

QuickBooks 101

+ More Info

14 hours

1.4 CEUs

QuickBooks 101

+ More Info

-

7 hours

0.7 CEUs

Accounts Payable Management

+ More Info

7 hours

0.7 CEUs

Accounts Payable Management

+ More Info

-

8 hours

0.8 CEUs

Motivational and Public Speaking 101

+ More Info

8 hours

0.8 CEUs

Motivational and Public Speaking 101

+ More Info

-

5 hours

0.5 CEUs

Operations Management 101

+ More Info

5 hours

0.5 CEUs

Operations Management 101

+ More Info

-

8 hours

0.8 CEUs

Microsoft Access Level 1

+ More Info

8 hours

0.8 CEUs

Microsoft Access Level 1

+ More Info

-

7 hours

0.7 CEUs

Introduction to Logic

+ More Info

7 hours

0.7 CEUs

Introduction to Logic

+ More Info

-

7 hours

0.7 CEUs

Business Analysis

+ More Info

7 hours

0.7 CEUs

Business Analysis

+ More Info

-

6 hours

0.6 CEUs

Debt Reduction

+ More Info

6 hours

0.6 CEUs

Debt Reduction

+ More Info

-

32 hours

3.2 CEUs

Accounting & Bookkeeping 101 for Everyone

+ More Info

32 hours

3.2 CEUs

Accounting & Bookkeeping 101 for Everyone

+ More Info

-

7 hours

0.7 CEUs

Financial Analysis 101: Planning and Control

+ More Info

7 hours

0.7 CEUs

Financial Analysis 101: Planning and Control

+ More Info

-

7 hours

0.7 CEUs

Organizational Behavior in Business

+ More Info

7 hours

0.7 CEUs

Organizational Behavior in Business

+ More Info

-

5 hours

0.5 CEUs

Accounts Receivable Management

+ More Info

5 hours

0.5 CEUs

Accounts Receivable Management

+ More Info

-

7 hours

0.7 CEUs

Understanding Financial Statements

+ More Info

7 hours

0.7 CEUs

Understanding Financial Statements

+ More Info